Up to 90,000 e-truck charging points will be needed over the next decade for the transition to carbon-neutral road transport, according to Scania’s chief executive.

But this means going from a base of nearly zero public e-truck charging points, said Henrik Henriksson, who is also chairman of commercial vehicle board within the European Automobile Manufacturers’ Association (ACEA).

“Obviously our industry is currently grappling with immediate issues related to the Covid-19 crisis,” said Henriksson.

“Despite this, we are keeping the long-term climate objectives in sight. Neither the truck industry nor policy makers can afford to drop the ball on this right now.”

Last year, the European Union adopted its first-ever CO2 standards for heavy-duty vehicles which will be -15% in 2025 rising to -30% by 2030.

“These CO2 targets for trucks set extremely challenging milestones on the road towards carbon neutrality. To deliver these steep reductions, we are committed and ready to bring a growing number of zero-emission trucks to the market,” said Henriksson.

However, the overwhelming majority of trucks sold in Europe today still runs on diesel, as it is the most convenient and cost-efficient energy carrier available to transport operators.

But statistics now reveal the exact composition of the EU market for new trucks by fuel type. These ACEA numbers show that 97.9% of all medium and heavy trucks sold in 2019 ran on diesel, 0.1% ran on petrol, 1.7% ran on natural gas, 0.2% were electrically-chargeable and 0.1% were hybrid electric.

According to ACEA estimates, by 2030, a fleet of around 200,000 battery-electric trucks will be needed in operation in the EU to meet the CO2 target set for that year.

With around 700 medium and heavy battery-electric trucks over 3.5 tonnes sold last year, this means that sales of electric trucks will have to grow 28 times over the next decade.

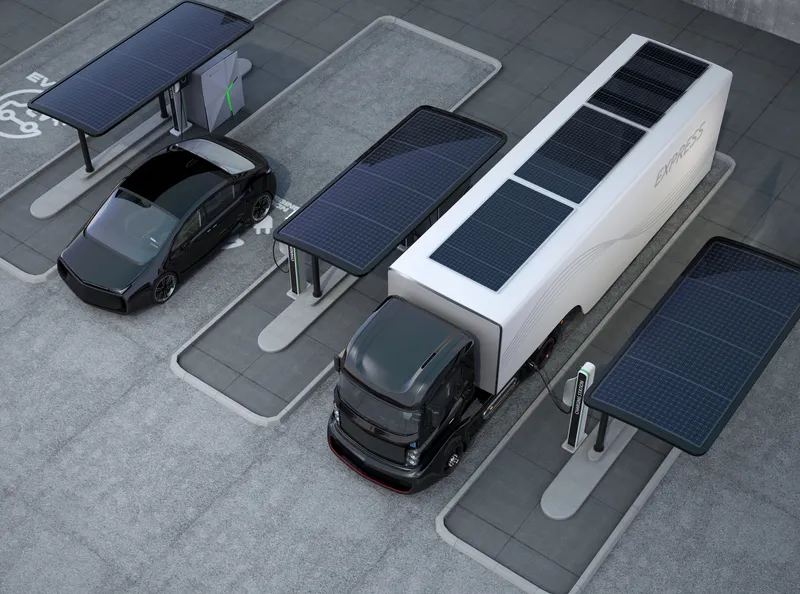

“The roll-out of a dense network of infrastructure for alternatively-powered trucks is one of the key prerequisites for achieving carbon-neutral road freight transport,” noted Henriksson.

“We urgently need Europe to introduce binding commitments for the deployment of at least 37,000 charging points, 50 hydrogen filling stations and 750 LNG-stations suitable for heavy-duty vehicles already by 2025.”

Heavy-duty vehicles simply cannot use passenger car infrastructure because of their much higher power and energy demand.

These trucks also need more parking space than a passenger vehicle and would need special access permit even if they could physically use the charge points.

The ACEA notes that if Europe is to achieve these minimum levels of deployment, binding truck infrastructure targets for member states must be set now by the Alternative Fuels Infrastructure Directive.

Missing technical standards should also be define and the necessary standardisation processes must start immediately, says the organisation.

Investment in charging and re-fuelling infrastructure will require significant financial and administrative support from the EU and national governments.

Transport operators in particular should be incentivised to invest early in private and semi-publicly accessible depot charging stations.