Miovision has raised $120 million to further develop its smart traffic platform.

By Ben Spencer

March 4, 2020

Read time: 1 min

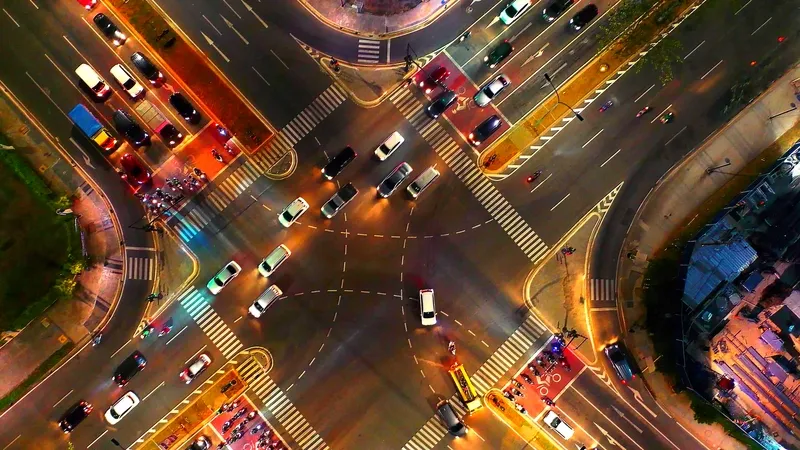

The company says it will use the Internet of Things (IoT) network of Telus Ventures – which led the funding round - to provide traffic signals allowing cities to remotely access, analyse and action data generated at intersections.

In 2017, Miovision launched the smart traffic platform to helps cities modernise their existing analogue traffic signals by adding connectivity and video-based, multimodal traffic measurement and analysis.

The Telus investment was supported by investors led by McRock Capital, which puts money into industrial IoT companies. RBC Capital Markets acted as Miovision’s exclusive private placement agent for this round of investment.