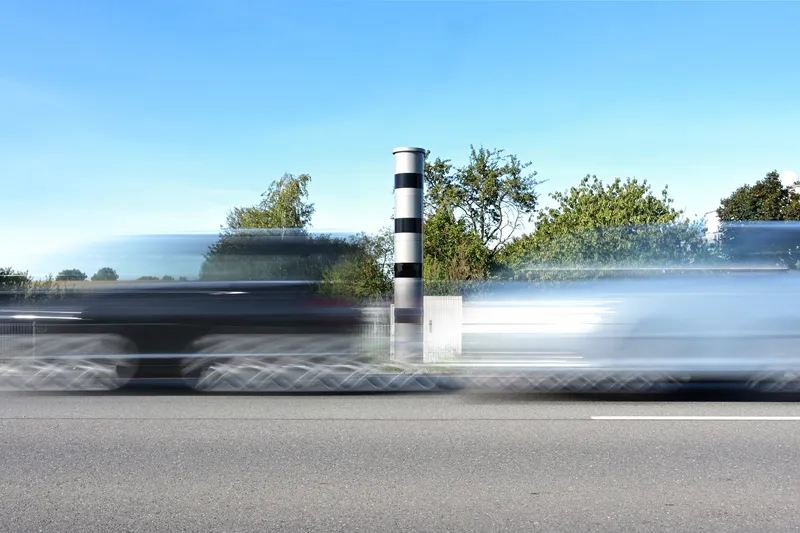

The UK Department for Transport has issued its provisional estimates of road traffic in Great Britain for the year ending June 2016 by vehicle type and road class.

These show that motor vehicle traffic was at a record high with 319.3 billion vehicle miles travelled, at 1.5 per cent higher than the previous year and 1.6 per cent higher than September 2007).

Rolling annual motor vehicle traffic has now increased each quarter in succession for three years.

Compared to the previous year, all road class

August 12, 2016

Read time: 2 mins

The UK 1837 Department for Transport has issued its provisional estimates of road traffic in Great Britain for the year ending June 2016 by vehicle type and road class.

These show that motor vehicle traffic was at a record high with 319.3 billion vehicle miles travelled, at 1.5 per cent higher than the previous year and 1.6 per cent higher than September 2007).

Rolling annual motor vehicle traffic has now increased each quarter in succession for three years.

Compared to the previous year, all road classes experienced a rise in motor vehicle traffic, apart from urban minor roads where the traffic remained at the same level. In particular, car traffic increased by 1.1 per cent to a record 249.2 billion vehicle miles, while van traffic continued to rise, increasing by 3.7 per cent to a new peak of 47.8 billion vehicle miles. HGV traffic rose on motorways and rural ‘A’ roads, but falling on urban ‘A’ roads

Traffic on motorways and rural A roads increased to new record levels, rising by 2.6 per cent and 2.9 per cent respectively.

According to Dr Graham Cookson, chief economist at163 Inrix the figures highlight the growing issue in the UK. He says, “With an ever-increasing population, higher employment rates and the urbanisation of areas up and down the county, we are continuing to see more drivers on the road, increased congestion in many major cities in the UK and, as a result, more time wasted in traffic. The significant task road authorities face in tackling the problem of increasing congestion cannot be underestimated.”

He said a more concerted effort is needed to improve infrastructure in order to handle this overwhelming demand for road travel. The Department for Transport statistics, showing an increase of 1.5 per cent in traffic and a decrease of 2.5 per cent in the average speed, support Inrix’s own figures on congestion which found London to be the most congested city in Europe and the UK is one of the most congested countries.

These show that motor vehicle traffic was at a record high with 319.3 billion vehicle miles travelled, at 1.5 per cent higher than the previous year and 1.6 per cent higher than September 2007).

Rolling annual motor vehicle traffic has now increased each quarter in succession for three years.

Compared to the previous year, all road classes experienced a rise in motor vehicle traffic, apart from urban minor roads where the traffic remained at the same level. In particular, car traffic increased by 1.1 per cent to a record 249.2 billion vehicle miles, while van traffic continued to rise, increasing by 3.7 per cent to a new peak of 47.8 billion vehicle miles. HGV traffic rose on motorways and rural ‘A’ roads, but falling on urban ‘A’ roads

Traffic on motorways and rural A roads increased to new record levels, rising by 2.6 per cent and 2.9 per cent respectively.

According to Dr Graham Cookson, chief economist at

He said a more concerted effort is needed to improve infrastructure in order to handle this overwhelming demand for road travel. The Department for Transport statistics, showing an increase of 1.5 per cent in traffic and a decrease of 2.5 per cent in the average speed, support Inrix’s own figures on congestion which found London to be the most congested city in Europe and the UK is one of the most congested countries.