Sensys Traffic has signed a cooperation agreement worth US$1.4 million with Japanese IT, telecommunications and information company to develop speed monitoring equipment for the Japanese market.

Japan, which has around 127 million inhabitants, experiences approximately 4,100 traffic fatalities per year, with vulnerable road users a significant part of these.

Japan currently has older –type fixed speed enforcement systems installed on its highways and the police also use several different types of mob

July 14, 2015

Read time: 2 mins

Japan, which has around 127 million inhabitants, experiences approximately 4,100 traffic fatalities per year, with vulnerable road users a significant part of these.

Japan currently has older –type fixed speed enforcement systems installed on its highways and the police also use several different types of mobile speed enforcement systems. The police have recently given priority to traffic safety measures for vulnerable road users with a focus on school children as they are particularly exposed in the dense traffic environment in the country’s cities.

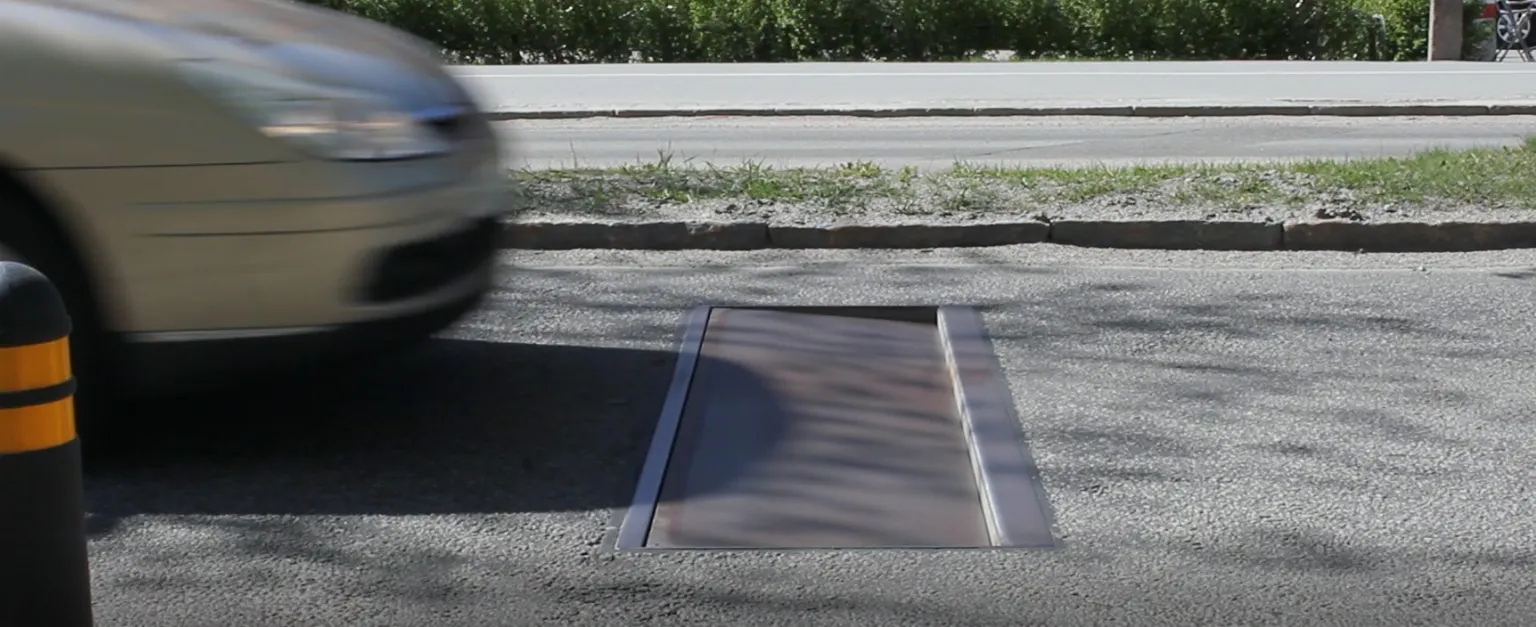

For this purpose, Sensys has developed a smaller size speed warning safety system for this purpose, to blend into the Japanese city environment. This product is included in the agreement between Sensys and OKI, which means that Sensys commits to industrialise the speed warning safety system, i.e., to prepare the product for serial production. The industrialisation is expected to be complete by the end of 2015.

"This is a strategic breakthrough for us in Japan. Considering the similarities between Japan and Sweden when it comes to the traffic safety culture, and considering that Japan is 13 times larger than Sweden in terms of population with the sixth largest road network in the world, we see a significant potential in the Japanese market. Therefore we are also very happy and proud to be cooperating with such an important partner in the Japanese market as OKI" says Sensys CEO Torbjörn Sandberg.