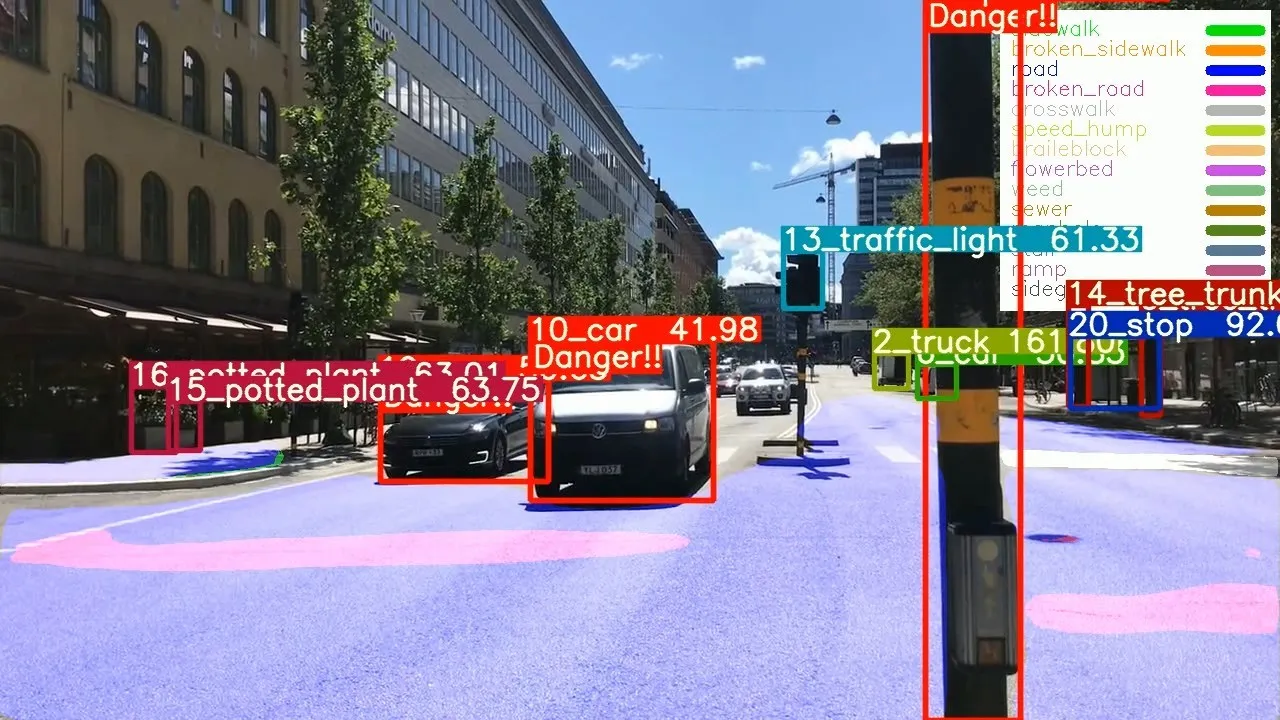

Self-learning artificial intelligence (AI) in cars is the key to unlocking the capabilities of autonomous cars and enhancing value to end users through virtual assistance, according to Frost & Sullivan. It offers original equipment manufacturers (OEMs) fresh revenue streams through licensing, partnerships and new mobility services. Simultaneously, the use-case scenarios of self-learning AI in cars are drawing several technology companies, Internet of Things (IoT) companies and mobility service providers to

December 15, 2016

Read time: 2 mins

Self-learning artificial intelligence (AI) in cars is the key to unlocking the capabilities of autonomous cars and enhancing value to end users through virtual assistance, according to 2097 Frost & Sullivan. It offers original equipment manufacturers (OEMs) fresh revenue streams through licensing, partnerships and new mobility services. Simultaneously, the use-case scenarios of self-learning AI in cars are drawing several technology companies, Internet of Things (IoT) companies and mobility service providers to the automotive industry. The technology has also attracted attention and investments from the government due to its potential to elevate lifestyles and add economic value.

Frost & Sullivan’s Automotive & Transportation Growth Partnership Service program, which offers, among other things insights into powertrains, carsharing and smart mobility management has recently released the following analyses of artificial intelligence in cars: Frost & Sullivan’s new, Executive Analysis of Self-learning Artificial Intelligence in Cars, Forecast to 2025, aims to analyse self-learning car technology and its value contribution to the automotive industry.

By 2025, four levels of self-learning technology will disrupt the automotive industry. Level 4 self-learning car ownership will be vital for new mobility companies, stoking partnerships with original equipment manufacturers (OEMs). OEMs are already making strategic investments or acquisitions for Level 3 and Level 4 self-learning technology; there are several prominent start-ups in the market.

“Technology companies are expected to be the new Tier I for OEMs for deep-learning technology,” said Frost & Sullivan Intelligent Mobility research analyst Sistla Raghuvamsi. “Google and NVIDIA will be key companies within this space, dominating the market by 2025. Meanwhile, 13 OEMs will be investing over US$7 billion in the development of various AI use cases.1684 Hyundai, 1686 Toyota, and 1959 GM will account for 53.4 per cent of the total investment share.”

The challenge for technology developers lies in gathering the data required to train the AI to support self-driving capabilities. This is prompting the development of artificial simulations to run trained AI, as well as the creation of low-cost level 2 systems for driver analytics and assistance that can eventually provide data for levels 3 and 4.

“High processing capability with low power consumption will be critical to enable various levels of self-learning cars,” noted Raghuvamsi. “By 2025, level 4 self-learning cars will integrate home, work and commercial networks, enhancing the value to end users."

Frost & Sullivan’s Automotive & Transportation Growth Partnership Service program, which offers, among other things insights into powertrains, carsharing and smart mobility management has recently released the following analyses of artificial intelligence in cars: Frost & Sullivan’s new, Executive Analysis of Self-learning Artificial Intelligence in Cars, Forecast to 2025, aims to analyse self-learning car technology and its value contribution to the automotive industry.

By 2025, four levels of self-learning technology will disrupt the automotive industry. Level 4 self-learning car ownership will be vital for new mobility companies, stoking partnerships with original equipment manufacturers (OEMs). OEMs are already making strategic investments or acquisitions for Level 3 and Level 4 self-learning technology; there are several prominent start-ups in the market.

“Technology companies are expected to be the new Tier I for OEMs for deep-learning technology,” said Frost & Sullivan Intelligent Mobility research analyst Sistla Raghuvamsi. “Google and NVIDIA will be key companies within this space, dominating the market by 2025. Meanwhile, 13 OEMs will be investing over US$7 billion in the development of various AI use cases.

The challenge for technology developers lies in gathering the data required to train the AI to support self-driving capabilities. This is prompting the development of artificial simulations to run trained AI, as well as the creation of low-cost level 2 systems for driver analytics and assistance that can eventually provide data for levels 3 and 4.

“High processing capability with low power consumption will be critical to enable various levels of self-learning cars,” noted Raghuvamsi. “By 2025, level 4 self-learning cars will integrate home, work and commercial networks, enhancing the value to end users."