A group seeking to improve American oil security through domestic production, fuel competition, driverless technology and anti-cartel measures has called on policymakers to remove regulatory hurdles in order to accelerate the deployment of self-driving cars, as well as revise tax incentives to boost sales of less expensive electric vehicles.

Securing America’s Future Energy (SAFE), chaired by FedEx Corporation chairman, president and CEO Frederick W. Smith and retired US Marine Corps Commandant James Con

May 20, 2016

Read time: 2 mins

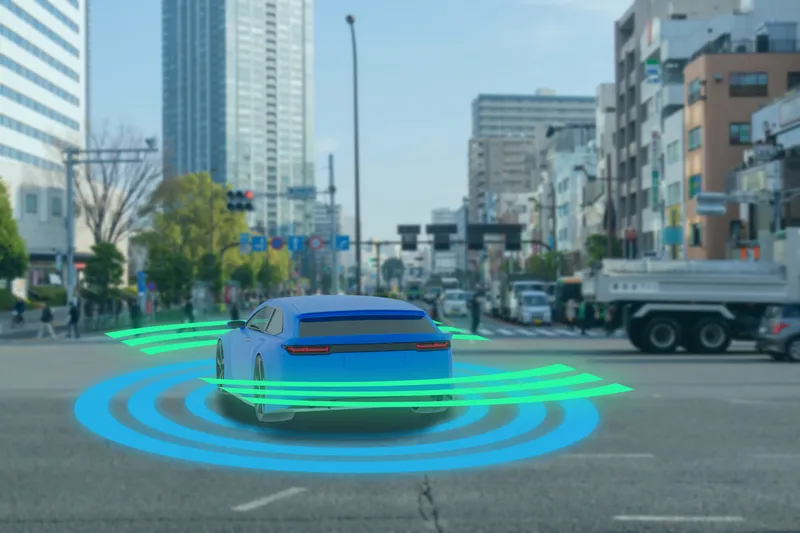

A group seeking to improve American oil security through domestic production, fuel competition, driverless technology and anti-cartel measures has called on policymakers to remove regulatory hurdles in order to accelerate the deployment of self-driving cars, as well as revise tax incentives to boost sales of less expensive electric vehicles.

Securing America’s Future Energy (SAFE), chaired by FedEx Corporation chairman, president and CEO Frederick W. Smith and retired US Marine Corps Commandant James Conway, has released a report, recommending the removal of federal regulatory obstacles to the deployment of autonomous vehicles and allow broad commercialisation once they are as safe as today’s cars.

The report also recommends that federal rules on autonomous vehicles should pre-empt state standards and regulation on automotive safety should evolve to a more flexible and collaborative model based on performance-based standards.

It also proposes the establishment of autonomous vehicle deployment communities to test the technology and encourage public engagement.

These recommendations were supplemented with policy recommendations to accelerate the adoption of advanced fuel vehicles powered by diverse energy sources, including restructuring federal tax incentive for electric vehicles to remove the 200,000 vehicle-per-manufacturer cap and phase down beginning in 2021.

SAFE also proposes reducing the value of the federal electric vehicle tax credit for vehicles over US$40,000 and removing it completely for vehicles over US$55,000.

“We’re on the cusp of the largest ground transportation transformation since the invention of the Model T, and we must ensure that unnecessary and outdated regulations don’t encumber its potential. Through a wholly new value proposition that promises a fundamental shift in how we move people and goods, autonomous vehicles will accelerate the adoption of advanced fuel vehicles while making our roads safer and our transportation system far more efficient,” said Smith.

Securing America’s Future Energy (SAFE), chaired by FedEx Corporation chairman, president and CEO Frederick W. Smith and retired US Marine Corps Commandant James Conway, has released a report, recommending the removal of federal regulatory obstacles to the deployment of autonomous vehicles and allow broad commercialisation once they are as safe as today’s cars.

The report also recommends that federal rules on autonomous vehicles should pre-empt state standards and regulation on automotive safety should evolve to a more flexible and collaborative model based on performance-based standards.

It also proposes the establishment of autonomous vehicle deployment communities to test the technology and encourage public engagement.

These recommendations were supplemented with policy recommendations to accelerate the adoption of advanced fuel vehicles powered by diverse energy sources, including restructuring federal tax incentive for electric vehicles to remove the 200,000 vehicle-per-manufacturer cap and phase down beginning in 2021.

SAFE also proposes reducing the value of the federal electric vehicle tax credit for vehicles over US$40,000 and removing it completely for vehicles over US$55,000.

“We’re on the cusp of the largest ground transportation transformation since the invention of the Model T, and we must ensure that unnecessary and outdated regulations don’t encumber its potential. Through a wholly new value proposition that promises a fundamental shift in how we move people and goods, autonomous vehicles will accelerate the adoption of advanced fuel vehicles while making our roads safer and our transportation system far more efficient,” said Smith.