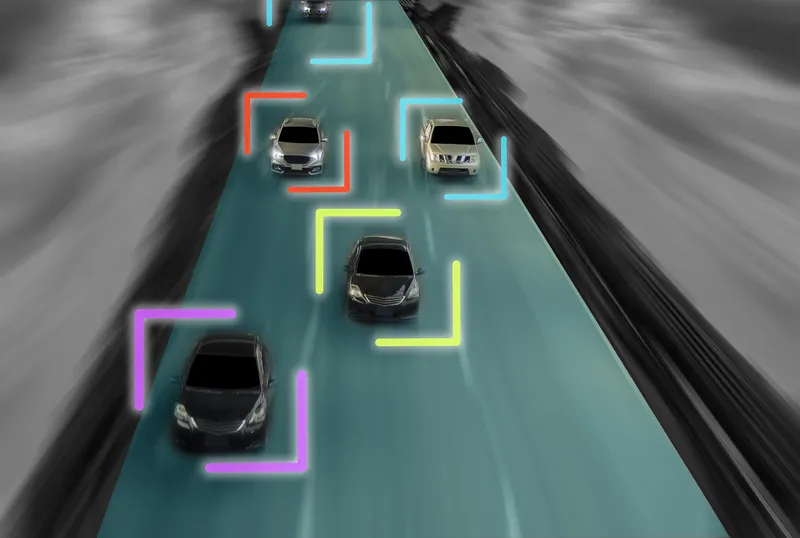

Research by Visiongain claims that the worldwide demand for connected cars is increasing at a rapid pace. Last year, the amount of customers willing to change the car brand for better connectivity has almost doubled. The willingness to pay the subscription for connected services went up by 10% in the same period. Chinese consumers are especially excited about car connectivity; more than half are willing to change their car for better connectivity.

Visiongain assesses that sales of new passenger cars equi

June 20, 2016

Read time: 2 mins

Research by Visiongain claims that the worldwide demand for connected cars is increasing at a rapid pace. Last year, the amount of customers willing to change the car brand for better connectivity has almost doubled. The willingness to pay the subscription for connected services went up by 10% in the same period. Chinese consumers are especially excited about car connectivity; more than half are willing to change their car for better connectivity.

Visiongain assesses that sales of new passenger cars equipped with either V2V, V2I, V2H or IN-V communication modules will face a significant growth in the next 10 year, 2016-2026. DSRC modules are expected to be the norm connectivity technology for V2V communications towards the end of the forecast with LTE, GPS, and sensor-based modules enabling the adoption of safety and convenience for in-vehicle applications.

"V2X is an inconspicuous industry which has consolidated through regulation and investments from governments and corporations respectively. The forecasted period suggests a tremendous development of the V2V subsector which will result in more than 140 million cars being fully deployed with the connectivity solutions. V2I and V2H are both in the infancy stage which suggests there is still space for legislation and profits. Our forecast, which has implemented model and trend factor analysis, indicates a significant growth for the V2X industry with the total earnings surpassing US$150 billion for DSCR and V2X installation for the next decade. The market offers wide profit margins and high development potentials which are presented in our report," says - Sergej Gavrilov, Visiongain Automotive Industry analyst.

Visiongain assesses that sales of new passenger cars equipped with either V2V, V2I, V2H or IN-V communication modules will face a significant growth in the next 10 year, 2016-2026. DSRC modules are expected to be the norm connectivity technology for V2V communications towards the end of the forecast with LTE, GPS, and sensor-based modules enabling the adoption of safety and convenience for in-vehicle applications.

"V2X is an inconspicuous industry which has consolidated through regulation and investments from governments and corporations respectively. The forecasted period suggests a tremendous development of the V2V subsector which will result in more than 140 million cars being fully deployed with the connectivity solutions. V2I and V2H are both in the infancy stage which suggests there is still space for legislation and profits. Our forecast, which has implemented model and trend factor analysis, indicates a significant growth for the V2X industry with the total earnings surpassing US$150 billion for DSCR and V2X installation for the next decade. The market offers wide profit margins and high development potentials which are presented in our report," says - Sergej Gavrilov, Visiongain Automotive Industry analyst.