Almost 70% of the world’s population will be living in cities by 2050, according to a recent United Nations study - while some researchers believe this figure could be as high as 90%. The need for this growing urban population to live safely and prosperously will require financial investment in disruptive technologies.

Master plans for future smart cities - such as Dubai in United Arab Emirates, China’s Shenzhen and Woven City in Japan - include a range of systems designed to provide a sustainable environment for their citizens.

One of the biggest challenges will be to tackle rising levels of traffic congestion, with solutions such as autonomous vehicles, congestion charging, car-pooling and traffic-free zones being proposed. One area that is often overlooked is how to improve logistics networks and reduce the number of freight-carrying vehicles within urban areas.

Vehicle use is obviously an important part of city infrastructure and many businesses rely on vans and articulated vehicles to provide essential services and the delivery of goods.

Some cities are championing the last-mile delivery systems which prevent delivery vehicles from entering city centres and urban residences. Not only does this have environmental benefits by reducing levels of air pollution, but also provides financial ones too, given that congestion can be expensive.

However, even in pre-pandemic times, the number of delivery vehicles on our roads was growing fast. The UK Department for Transport reports that, between 1993 and 2018, van traffic saw the fastest growth of any motor vehicle, almost doubling to reach a record high of 51 billion vehicle miles.

These miles are clocked up by vans and articulated vehicles delivering more than 2.5 billion parcels and an estimated one billion online grocery orders to homes throughout the UK.

This trend is increasing, particularly in the US with growth in online grocery sales increasing six-fold in the last 12 months and the number of online shopping days exceeding $2 billion growing from just two in 2019 to 130 now. Globally, the situation is only expected to increase as we see a dramatic shift towards e-commerce and more people working from home.

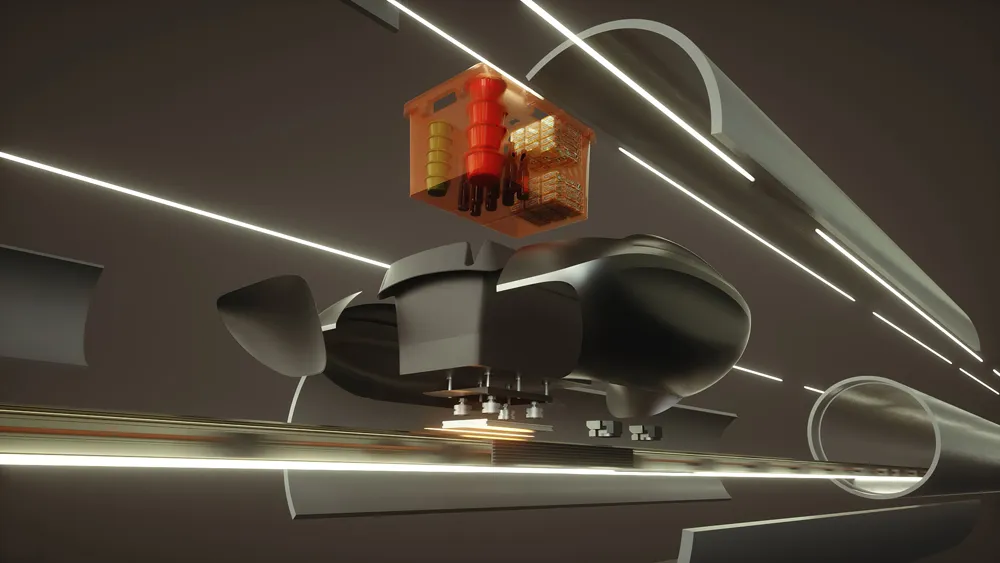

Underground freight systems, like the one developed by Magway to transport online customer orders through a network of pipes, could provide the logistics backbone for future new smart capital cities such as those planned in Indonesia and Nepal, and other major international developments.

Within cities themselves, new apartments and office blocks have a ready-made receptacle for deliveries with underground car parking generally already incorporated into the designs. As car ownership is expected to decline, these, as well as under-utilised car parks, present a great opportunity for smart cities to embrace such technology.

New underground freight delivery systems would provide short delivery routes to alleviate the stress on local freight traffic travelling in and out of major airport hubs, with longer routes of up to 100 km eventually running along motorways, A-roads and rail lines.

The strict Covid-19 lockdown measures witnessed throughout the world’s major cities have perhaps provided a glimpse of what future cities might look like. Fewer vehicles on our roads, cleaner air and safer, more sustainable ways of moving from A to B are at least a few positives to have emerged. Continuation of such environmental progress will also require a step-change in our approach to reducing traffic congestion; one that embraces innovation and adopts a more visionary approach.

We are at a crossroads where the interests of governments, the public and commercial organisations are aligned. A more holistic approach to smart city design is required; one that should include provision for the construction of sustainable infrastructure to allow freight and e-commerce deliveries to be made in a safe, more efficient and environmentally-friendly way.

ABOUT THE AUTHOR: Phill Davies is co-founder of Magway